Why parcelLab?

Discover why parcelLab is the go-to post-purchase partner for top retailers across the globe

Why parcelLab?

Discover why parcelLab is the go-to post-purchase partner for top retailers across the globe

Why parcelLab

Why top retailers choose parcelLab over the rest

AI and innovation

Transforming post-purchase with AI

PPX maturity curve

Discover where you stand on the curve

PPX Institute

Turn transactional relationships into customers for life

Post-purchase audit

Experience your brand the way your customers do

Platform

Platform support

PLATFORM

Meet the platform

The industry’s first and only PPX platform tailor-made for retailers

WHAT'S NEW

Benchmarking

Benchmark against the industry in real-time

Copilot

Turn delivery anxiety into customer satisfaction with AI

AI Email Editor

Streamline operations and reduce complexity with AI-powered automation

Campaign Manager 2.0

Run campaigns that drive revenue

Smart Survey

Collect feedback and drive improvements

OVERVIEW

Enhance delivery experience

Seize control of your delivery experience

CAPABILITIES

Track & communicate

Keep your customers engaged

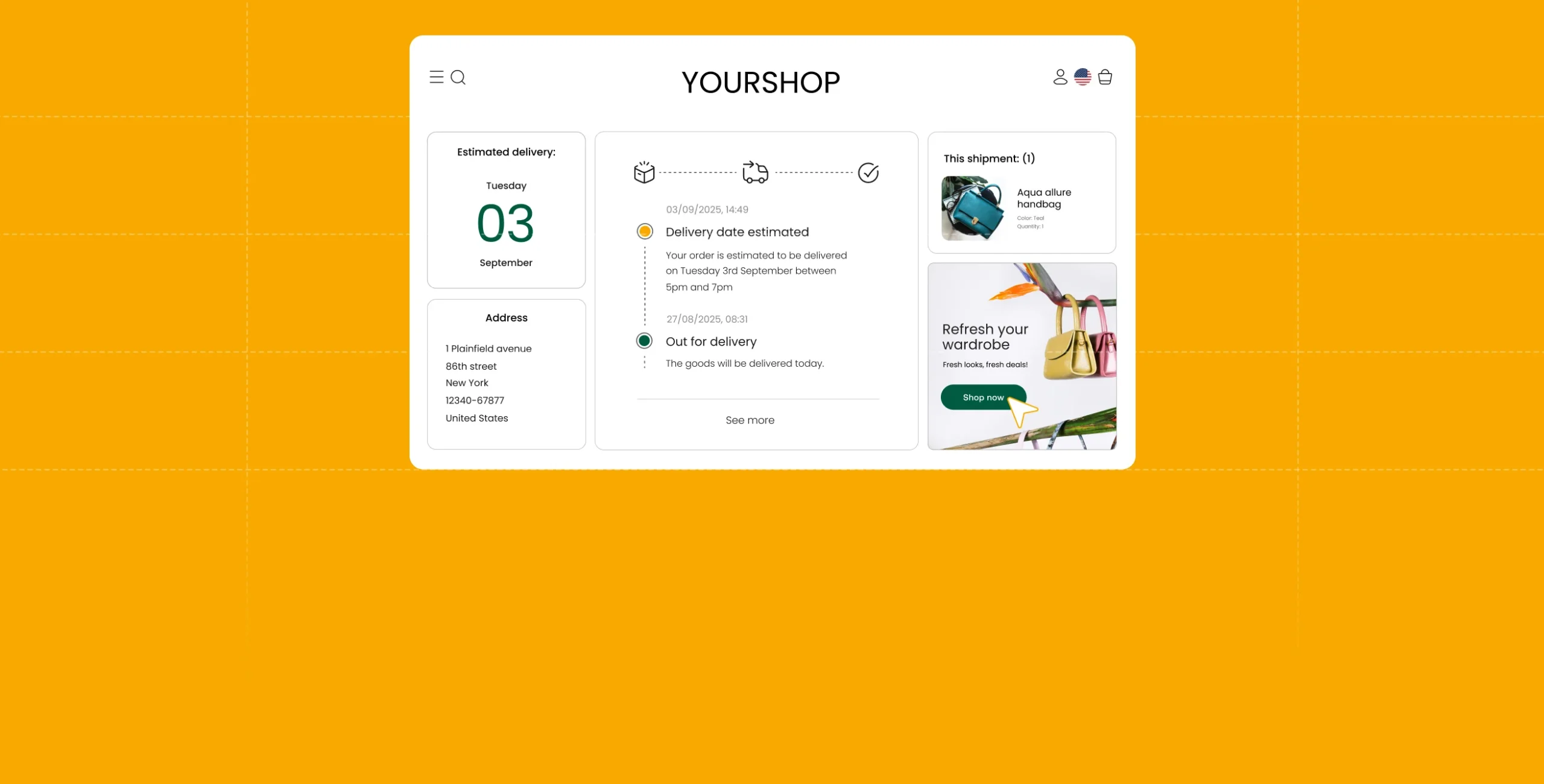

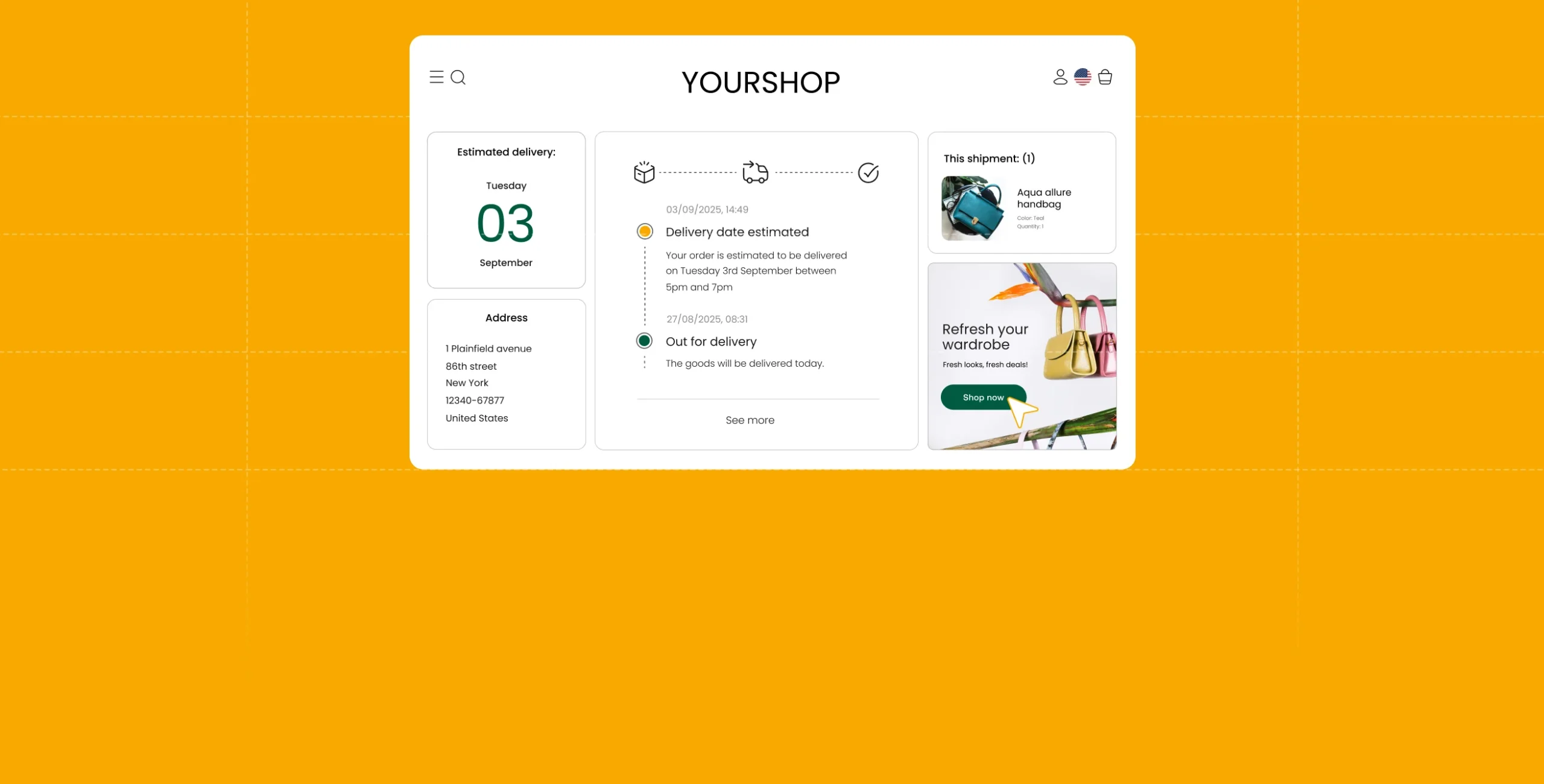

Set up a branded tracking portal

Keep customers in your ecosystem

Create personalized journeys

Deliver the right message, at the right time

Run targeted campaigns

Create campaigns that convert

Predict delivery delays

See delivery issues before they happen and take proactive action

Streamline claims management

Reclaim time, revenue, and customer trust

Resolve customer inquiries

Empower your customer service teams

OVERVIEW

Make returns seamless

Transform customer dissatisfaction into revenue retention by digitizing returns and exchanges.

CAPABILITIES

Track and inform returns status

Create a seamless returns experience that retains customers

Self-service returns portal

Let customers register returns with ease

Personalize returns journey

Encourage exchanges over refunds

Forecast returns volume

Anticipate return patterns before they happen

Offer flexible returns

Give your customers versatile return options that cater to their preferences

OVERVIEW

AI-powered post-purchase

Optimize every post-purchase interaction with parcelLab's AI agents

CAPABILITIES

Execute with AI

Harness the power of AI agents

Predict with AI

Stay ahead with real-time insights & forecasts

Simplify with AI

Cut complexity & streamline operations

Personalize with AI

Deliver tailored experiences

Solutions

Reduce WISMO & WISMR calls

Keep customers in the loop & support smarter

Turn returns into revenue

Make returns seamless, maximize revenue

Manage complex post-purchase scenarios

Handle exceptions, claims & logistics

Optimize post-purchase campaigns

Boost engagement & drive conversions

Enhance personalization and engagement

Create 1:1 tailored experiences

Customer success stories

Join the leading brands worldwide. You're in good company.

Resources

Company

Why parcelLab?

Discover why parcelLab is the go-to post-purchase partner for top retailers across the globe

Why parcelLab

Why top retailers choose parcelLab over the rest

AI and innovation

Transforming post-purchase with AI

PPX maturity curve

Discover where you stand on the curve

PPX Institute

Turn transactional relationships into customers for life

Post-purchase audit

Experience your brand the way your customers do

PLATFORM

Meet the platform

The industry’s first and only PPX platform tailor-made for retailers

WHAT'S NEW

Benchmarking

Benchmark against the industry in real-time

Copilot

Turn delivery anxiety into customer satisfaction with AI

AI Email Editor

Streamline operations and reduce complexity with AI-powered automation

Campaign Manager 2.0

Run campaigns that drive revenue

Smart Survey

Collect feedback and drive improvements

OVERVIEW

Enhance delivery experience

Seize control of your delivery experience

CAPABILITIES

Track & communicate

Keep your customers engaged

Set up a branded tracking portal

Keep customers in your ecosystem

Create personalized journeys

Deliver the right message, at the right time

Run targeted campaigns

Create campaigns that convert

Predict delivery delays

See delivery issues before they happen and take proactive action

Streamline claims management

Reclaim time, revenue, and customer trust

Resolve customer inquiries

Empower your customer service teams

OVERVIEW

Make returns seamless

Transform customer dissatisfaction into revenue retention by digitizing returns and exchanges.

CAPABILITIES

Track and inform returns status

Create a seamless returns experience that retains customers

Self-service returns portal

Let customers register returns with ease

Personalize returns journey

Encourage exchanges over refunds

Forecast returns volume

Anticipate return patterns before they happen

Offer flexible returns

Give your customers versatile return options that cater to their preferences

OVERVIEW

AI-powered post-purchase

Optimize every post-purchase interaction with parcelLab's AI agents

CAPABILITIES

Execute with AI

Harness the power of AI agents

Predict with AI

Stay ahead with real-time insights & forecasts

Simplify with AI

Cut complexity & streamline operations

Personalize with AI

Deliver tailored experiences

Reduce WISMO & WISMR calls

Keep customers in the loop & support smarter

Turn returns into revenue

Make returns seamless, maximize revenue

Manage complex post-purchase scenarios

Handle exceptions, claims & logistics

Optimize post-purchase campaigns

Boost engagement & drive conversions

Enhance personalization and engagement

Create 1:1 tailored experiences

Customer success stories

Join the leading brands worldwide. You're in good company.

Resources

Company

Our parcelLab E-Commerce Shipping Study 2021 analyzes the top 100 German online stores in the areas of checkout, shipping and returns. How exactly does that work? We conducted test orders at the most successful German online retailers at the end of last year for this purpose. Which companies are the best in terms of operations experience?

Most major online retailers have significantly improved the customer experience in recent years. However, there is still room for improvement when it comes to shipping and returns services. Some online retailers are already setting the bar pretty high when it comes to checkout, shipping, delivery and returns. Almost every store operator can learn something from these best practice cases.

s.Oliver came out on top as the best in checkout in the 2021 e-commerce shipping study. Reasons for this: At s.Oliver, customers can choose their preferred logistics provider themselves. Furthermore, the store can score points with alternative delivery offers and express deliveries. Another big plus point for the store is the fact that all information is summarized again in the checkout as an overview.

In the shipping process IKEA can convince, because here customer loyalty is capitalized. By integrating an item list into the shipping notification, the company can offer its customers an outstanding shopping experience. The appreciation for the customer is also expressed through personalized communication that is adapted to the customer’s needs. The track & trace page is also very clear and designed in the branding of the store.

flaconi can secure the title of winner in delivery. The packaging in the branding of the online store is particularly convincing and thus improves the brand image of the company. However, flaconi also keeps the aspect of sustainability in mind and does not use any filling material made of plastic. The company thus focuses on a positive unpacking experience. This is rounded off by the inclusion of discount codes and coupons.

H&M makes the running when it comes to returns. Here, for example, a collection of the return is possible. Furthermore, the return of items at H&M is always free and easy, because the return label is already sent directly in the package. The customer is also informed at any time about the status of the return. The refund is also fast and hassle-free.

MediaMarktSaturn emerges from the study as the overall winner. The company offers its customers an outstanding shopping experience and has its operations experience under control. All important information is made available to the customer at all times – both by e-mail and in the customer account. MediaMarktSaturn is also optimizing its mobile ordering processes in the retailer app: all processes, from checkout to shipping and returns, have been adapted for mobile use and offer customers a positive user experience.

Not only customer satisfaction, but also efficient processes on the retailer side stand or fall with operational order processing, the Operations Experience (OX). This starts with service and winds its way through warehouse processing to shipping and returns. Yet companies still have little visibility and little to no control over the OX, as the E-Commerce Shipping Study 2020 shows. Many retailers still leave important contact points to the logistics service provider. A big mistake that results in not only insightful consumer data but also upselling opportunities being lost. Customers, in turn, receive only cryptic messages that keep them groping in the dark about their order status.

It is therefore elementary that retailers control all relevant process steps in fullfilment themselves. Only in this way can problems be identified and circumvented at an early stage and the customer proactively informed at all times. This is ultimately reflected in renewed store visits and an increase in sales. We offer workflow control at all relevant points in the process as well as individual, personalized customer communication. If a delivery is delayed, customers are automatically informed. At the same time, additional relevant content can be used to guide shoppers back into the store and encourage them to make a new purchase.

This benefits all sides: companies ensure a consistent brand experience and maximize cross-selling potential – not least because of the outstanding customer experience.

Sounds interesting, but you need help implementing your Operations Experience? No problem! We’re happy to help. Contact us!

An error has occurred, please try again later.An error has occurred, please try again later.

By submitting the form, you agree to receive marketing information according to our Privacy Policy. You can unsubscribe at any time.