Why post-purchase is fashion’s hidden growth engine in a slowing market

Contents

Learn how parcelLab can help turn your post-purchase experience into a growth driver.

The global fashion industry is navigating one of its most challenging periods in years. According to The McKinsey State of Fashion report, macroeconomic uncertainty, shifting consumer behavior, value pressure, and regional disparities are all shaping a market where growth is possible, but only for brands that adapt strategically.

Top-line revenue growth for fashion is expected to remain modest. Many traditional growth engines, like luxury spending and pure digital discovery, are under pressure. With consumers becoming increasingly price-conscious and competitive pressures intensifying, brands need new levers for differentiation and loyalty.

To cut to the chase, the post-purchase experience is now entering the chat for many retailers. It’s no longer considered an afterthought, but now a necessity to maintain a competitive advantage and keep customers happy.

Customers judge you after the buy button

Fashion brands can’t rely on product, price, or discovery alone to retain customers. McKinsey’s research shows that consumers are increasingly focused on value and experience. Loyalty is no longer a given.

In this environment, the post-purchase experience becomes a rare opportunity to influence how customers feel about a brand and whether they come back again. Often, pre-purchase engagement is mediated by marketplaces, search platforms, or social media influencers. On the other hand, post-purchase touchpoints such as delivery visibility, proactive communication, and returns remain owned by the brand. That ownership is a goldmine for building trust and loyalty.

At parcelLab, we’ve seen this play out firsthand with fashion brands of all sizes. The difference between a brand that simply fulfills orders and one that makes customers feel consistently valued often comes down to how the post-purchase experience is designed and executed.

Experience is everything

Take Hugo Boss, one of the world’s leading fashion houses. As the brand scaled its global eCommerce operations, it recognized that delivery and returns were critical moments for customer engagement. Their post-purchase journey includes real-time tracking and personalized communications. What once were routine shipping updates are now engaging touchpoints that reduce support inquiries, drive return visits to the brand site, and open doors for cross-sell and upsell opportunities.

This shift turns something traditionally seen as “logistics” into an end-to-end brand experience. Instead of customers wondering “Where’s my order?” with uncertainty, they’re met with clarity, transparency, and relevance. Factors that contribute directly to loyalty.

Think about today’s consumers, especially Gen Z. Shoppers are willing to trade down for value or look to resale or thrift stores. If they decide to purchase with your brand and you don’t earn their trust, they’ll switch to a different brand. That’s why the brands that focus on the post-purchase experience see higher customer loyalty than the ones that don’t.

Turning post-purchase into revenue growth

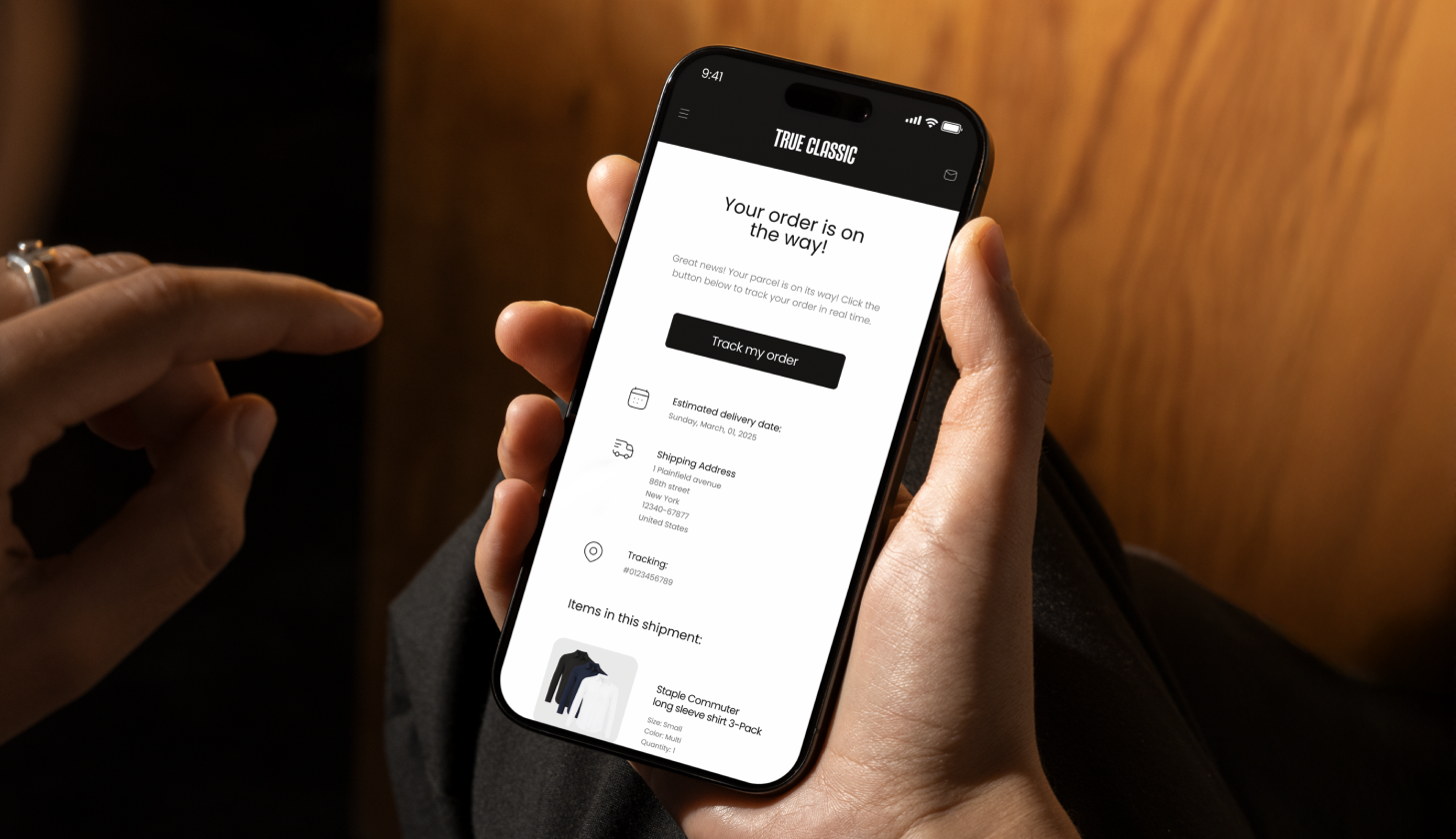

Another example comes from True Classic, a mid-sized fashion brand that used branded post-purchase messaging to directly influence revenue. True Classic saw a 29% increase in revenue per email driven by post-purchase engagement alone.

This is more than a one-off metric. It demonstrates a broader trend: post-purchase messaging can be a revenue driver when it goes beyond basic order updates. By embedding tailored content, offers, and recommendations into delivery communications, brands can seamlessly guide customers back into the shopping experience long after the initial purchase.

With AI-powered curation being a major focus for brand engagement moving forward, owning the post-purchase relationship gives brands a direct line to their customers that isn’t controlled by third parties.

Why returns and exchanges are competitive frontiers

An astronomical amount of money is lost each year to returns, and the fashion industry, unfortunately, has the highest return rates. While some returns are unavoidable, the returns experience represents an opportunity. It’s a moment of friction that, if handled elegantly, can dramatically increase loyalty.

Leading brands are rethinking returns as a relationship-building moment. When you make returns easy, transparent, and empathetic, customers feel like the brand understands them, and that builds emotional equity. While it may seem like a huge lift to revamp your returns journey, it is easier than you think. The returns management platform you use should work with you to adjust to any new rules, personalization, and refund methods that work with your return policy.

If you want to look into recommendations on how to reduce return rates, we have the blog for you.

Post-purchase as a strategic differentiator

Ultimately, McKinsey’s outlook for fashion is sluggish top-line growth and shifting consumer behavior. It just underscores the importance of competitive differentiation. Brands can no longer rely on product alone. They must offer experiences that justify customer loyalty.

Post-purchase is one of the few stages of the customer lifecycle where brands can consistently create value at scale. When brands have a strong post-purchase experience, they:

- Build customer trust and retention

- Turn delivery and returns into revenue opportunities

- Reinforce brand value beyond price

- Create moments that differentiate leading brands in a crowded market

Whether it’s a luxury heritage brand like Hugo Boss or a challenger like True Classic, the brands investing in post-purchase as a strategic experience are the ones capturing long-term loyalty and revenue growth.

Looking ahead

As the fashion industry evolves through economic headwinds and technological shifts, brands that continuously innovate their entire customer journey will stand out amongst the rest. The post-purchase is a core competitive advantage that fashion brands must embrace to thrive in a crowded, value-driven market.