Retail trends and predictions shaping eCommerce in 2026

Contents

Looking to improve your post-purchase experience in 2026?

A new year always feels like a reset button. December is the slow-motion sprint to the finish line, equal parts chaos, caffeine, and countdowns. But now that the dust has settled, it’s the perfect moment to recharge, reassess, and reimagine what 2026 might have in store.

Here are our biggest predictions for the year ahead.

Online vs. offline shopping keeps shifting—again

For years, online shopping held the spotlight. But the pendulum is swinging back toward in-person experiences. According to Forrester’s Consumer Pulse Surveys, consumers expect to do more in-person shopping, up seven points from 2023 to 2025.

So, what does this mean for post-purchase?

This is where an omnichannel strategy becomes make-or-break. As more shoppers choose email receipts over printed ones, retailers have a golden opportunity to extend the in-store moment into a personalized, digital follow-up. Think:

- A tailored email highlighting loyalty points earned

- Curated, “you might also love” recommendations based on what they bought

- Helpful setup, styling, or product-care guides

- A link to their digital order hub so they never lose info

- A short tutorial or inspirational content

The handoff between offline and online shouldn’t feel disjointed. Retailers who master this transition will win deeper engagement long after customers walk out the door.

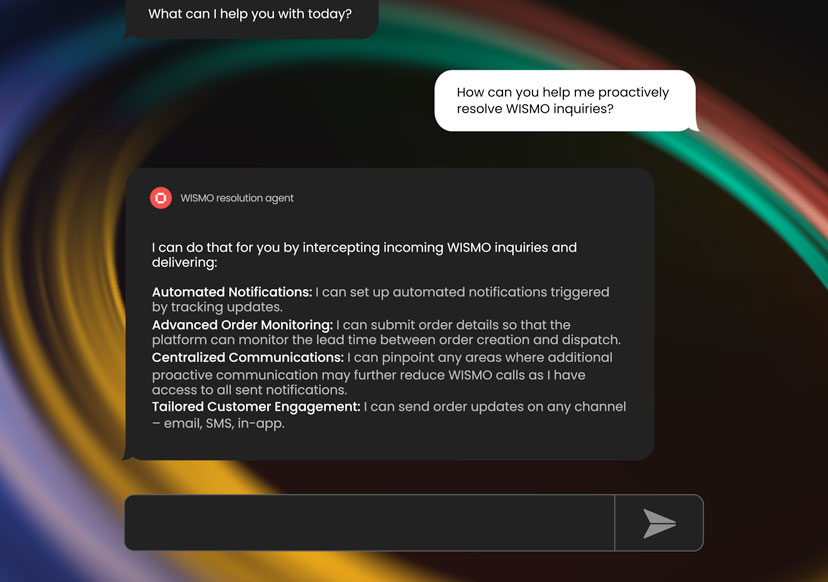

Customer experience teams will use AI more strategically

The AI land grab of 2024–2025 brought a wave of “AI-powered everything.” Some tools delivered real value. Others overpromised, underdelivered, or simply added noise.

This year, CX teams will get picky, and that’s a good thing. Small teams, especially, have leaned hard on AI to scale, triage, and automate repetitive tasks. But 2026 is when leaders begin evaluating AI less on novelty and more on true impact.

That means:

- Auditing which tools improved customer resolution times, personalization, or efficiency

- Cutting (or ignoring) AI features that added complexity without ROI

- Exploring underused AI capabilities hiding inside existing platforms

- Comparing notes with peers to understand what’s working across the industry

- Creating responsible AI standards internally

The winners in AI-powered CX won’t be the teams using the most AI. It will be the teams using AI well, with discipline, purpose, and clear customer value.

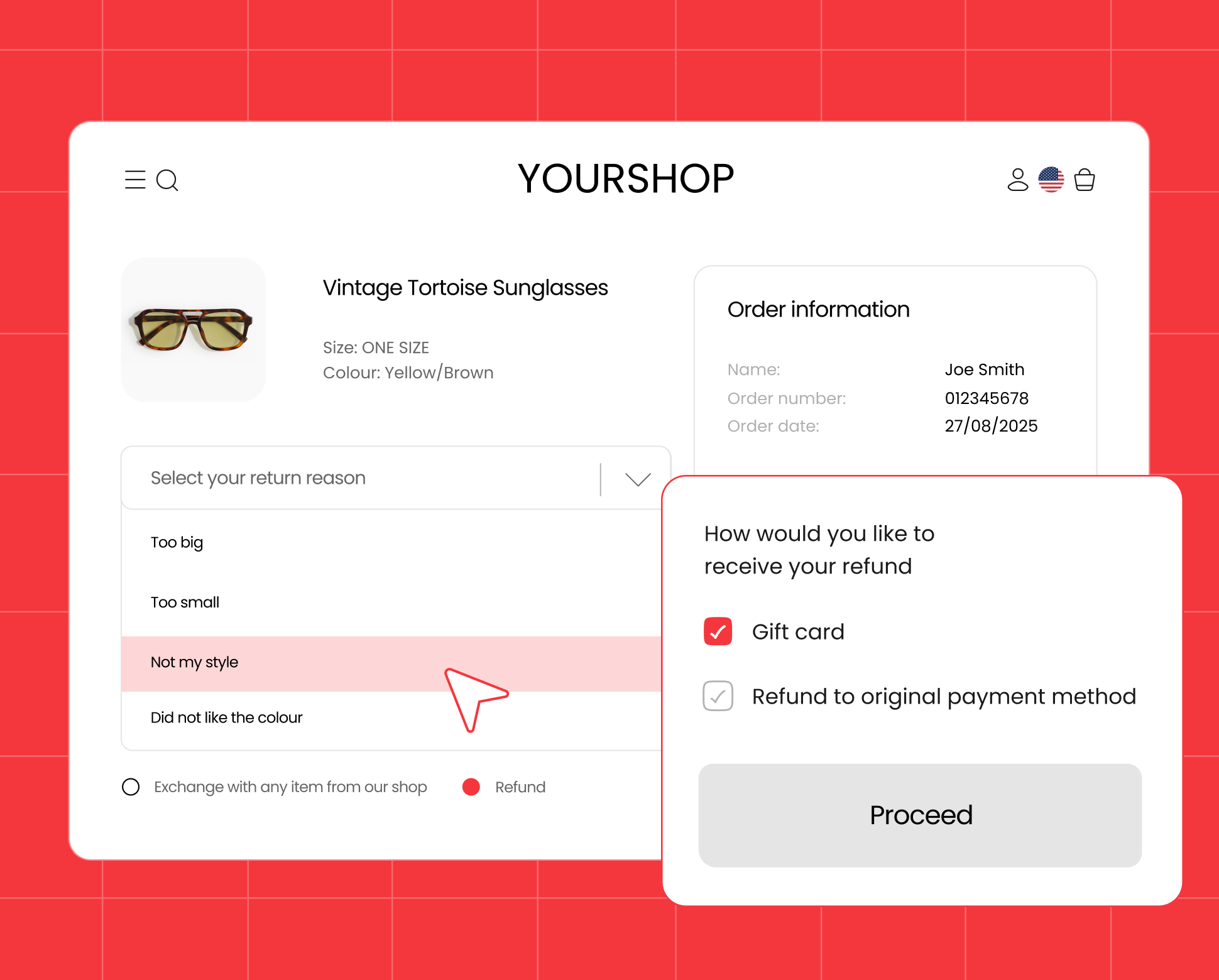

Return strategies will evolve

The returns landscape is becoming more complex, and 2026 will accelerate that trend.

In our own U.S. Shipping Study, only 49% of retailers still offered free returns, and that number will likely keep falling. With rising logistics costs, inflation-driven caution, and growing return fraud, retailers are rethinking their approach.

Expect to see:

- Personalized return policies based on loyalty, return history, and total lifetime value

- Premium return experiences for top customers (think instant refunds, extended windows, or no-questions-asked returns)

- Fees or restrictions for serial returners

- More automation in routing returns, identifying fraud, and predicting restock value

Both retailers and shoppers alike will be more wary of where their money goes this year.

Retailers will shift spend from acquisition to retention

For the last decade, acquisition has dominated marketing budgets. But rising ad costs, declining third-party data, and tighter margins across the board are forcing brands to rethink the math. 2026 will be the year retention strategies take the lead.

Acquiring a new customer has never been more expensive. Between rising CAC, fragmented channels, and intense competition, every new customer is harder and costlier to win. Retailers simply can’t rely on paid acquisition the way they used to.

Repeat customers are significantly more valuable. They spend more, buy more often, have lower service and support costs, and are more open to loyalty programs, bundles, and subscriptions.

Retention isn’t just sentimental. It’s financial. Therefore, retailers will focus on the following:

- Loyalty programs: Consumers want perks that feel earned, not generic. Expect retailers to build dynamic loyalty tiers, experiential perks, early access events, app-only rewards, and curated offers that feel exclusive.

- Personalized special offers: Blanket discounts lose margin and train customers to wait for sales. In 2026, brands will lean into personalized incentives, post-purchase surprise offers, invitation-only upsell moments, and time-sensitive “VIP perks” for high-value customers

- Premium post-purchase experiences as a retention engine: Where acquisition hits its limits, post-purchase fills the gap. New spend will go toward branded, high-engagement tracking experiences, seamless, self-service returns, personalized post-purchase journeys, product education content, and customer communities.

If acquisition answered the question “How do we get them in the door?”

Then, 2026 retention answers “How do we make them never want to leave?”

If 2025 taught us anything, it’s that customer expectations evolve fast, and they reward the brands that evolve even faster. As retailers rethink everything from returns to retention, 2026 offers a clean slate to build smarter, more thoughtful, and more human-centered experiences. The future of eCommerce isn’t just about efficiency; it’s about connection. And the retailers who embrace that will be the ones who win long-term loyalty.

Source:

Predictions 2026: Consumers, Forrester Research, Inc., October 21, 2025